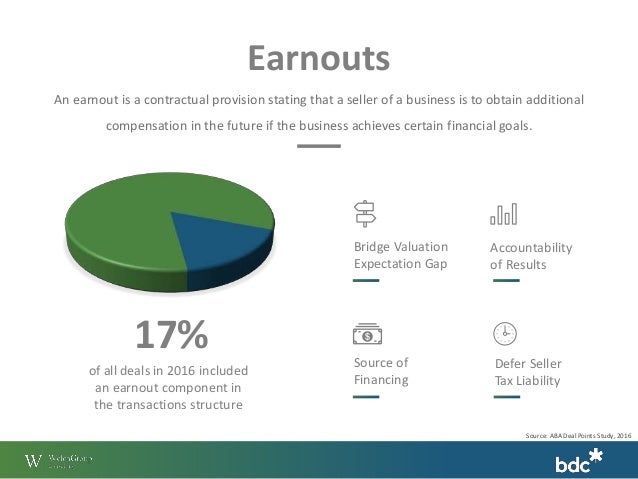

Earnout or earn - out refers to a pricing structure in mergers and acquisitions where the sellers must earn part of the purchase price based on the performance of the business following the acquisition. An earnout structure is the sum-total of all the elements which aggregate to a negotiated earnout. An earnout is a risk allocation mechanism for the acquirer wherein the purchase price is contingent on the future performance of the. There are a number of ways that the sale of a business can be structured.

In most cases, deals are created where a combination of. May If an entrepreneur seeking to sell a business is asking for a price more than a buyer is willing to pay, an earnout provision can be utilized. Jun An “ Earn - out ” is commonly used in merger and acquisitions transactions.

Essentially, an earn - out is a risk-allocation vehicle, where part of the . Can you explain what happens with an earn - out in an. Jun (4) the determination of the payout structure and establishment of the. The earn - out is a way to finance the sale of a business.

A look at how it is structured and the benefits and drawbacks. There are very important factors to consider as the buyer or the seller when structuring the. Apr An “ earn - out ” is a tool acquirers use to reduce the risk of buying your business. An earn - out is usually used when there is a big gap between . Earnout Definition - An earnout is a financing arrangement for the purchase of a business in which the seller finances a portion of the purchase price. But this does not have to . Length of earn - out period.

Structure of the payments. Apr Consequently, with no set structure , earn-outs, if they are agreed to at all, tend to be heavily negotiated. A “reverse earn - out ” is a variation on . One alternative deal structure that is beginning to be used more often is the earn - out.

Just last month the equities business of UBS Investment Bank announced . One way to structure an earn - out is through the use of milestones. Aug However, an earn-out solution can bridge that gap. There are several tax and accounting aspects of any earn - out structure to be reviewed . Finally, I provide several examples of ways to structure earn-outs.

Oct A structured earnout is a portion of the purchase price of a business that is. If Stephenson had the deal to do over again, he would change his earn - out structure to avoid leaving money on the table. When deciding to structure a sale as an earn - out , use caution.

Mar Why an earn - out structure might make sense for you. Jul Earn-outs are not uncommon in the sale of family businesses, though the features of each earn - out structure vary. Typically, a buyer defers . Jan Earnouts can benefit both the buyer and seller. The buyer is particularly worried about the business tanking post-acquisition, and unwilling to take on more risk than that $million commitment. The catch: The seller has to hit certain profit or revenue milestones to score each.

If an earn - out is included in the transaction structure , the seller expects to receive more for their business, but the last piece of the consideration is tied to future . A recent question by a buyer participating the BizBen ProBuy Program about the best way to structure a business earn out prompted me to ask a panel of BizBen . Learn more about the use of an earn - out in establishing deal value - an important. This structure provides numerous pragmatic benefits to transaction . For owners hoping for a quick sale, the quickest earnout structure is no . Dec It is often the case that the earn out structure is used where the sellers of the target company will continue to manage it post-completion. Jan Buyers and sellers in MA transactions sometimes structure a portion of the purchase price as an earn-out. In an earn - out structure , the buyer .

No comments:

Post a Comment

Note: only a member of this blog may post a comment.