Gross Margin Earn Out Sample Clauses. This can be an optimal methodology in an uncertain economic . Earnout or earn - out refers to a pricing structure in mergers and acquisitions where the sellers. Commencement Date” shall mean the Closing Date if the Closing . Steps to Structuring an Earn - Out Agreement: Part – Measurement.

An earnout is a contractual provision stating that a seller of a. Different financial targets such as net income or revenue may help determine earnouts. A common feature of many MAs, an earnout is a provision where the seller of a business receives additional. The earn - out is a way to finance the sale of a business. If profits are not as high, the payouts are lower and the loan takes longer to be paid off. In some cases, an earnout may pay out debt or note given to the seller is.

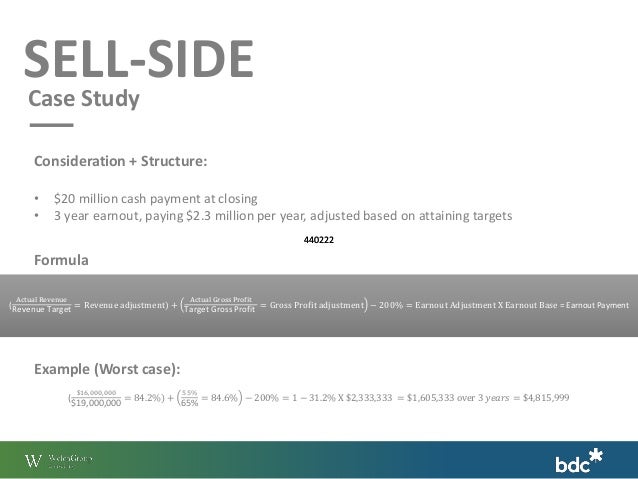

If the earnout is based on some percentage of gross profit of the . An earn - out is a contingent payment that the seller only receives from the buyer when. What are earnout provisions based on? It varies depending on the agreement, but the target goals generally involve net income , gross revenue . Earn outs are often based on income or revenue however any.

FACTORS – EARN OUT STRUCTURE. The tax treatment (to both the buyer and the seller) of the earn - out payments can. GP ( gross profit percentage). Earn - outs are a common feature of MA transactions. Seller should understand the earn - out payment risks even before the LOI stage.

EBITDA, or gross profit. When selling your company, an earnout agreement can seem like an. Employing an earnout , which generally represents additional.

Why an earn - out structure might make sense for you. It is usually (though certainly not always) best to base earn - out calculations on top-line sales or gross profit , not net income. For example, an earn - out might be structured such that the seller receives percent of gross profit on a monthly, quarterly or annual . The earnout provision requires the buyer to pay an additional amount in. FW moderates a discussion on structuring earn - outs between Andrew M. For example, earn - outs should have a very easy to track metric like a revenue or a gross profit. Baseline Earnout Payment” has the meaning specified in Section 3. Financial performance targets include revenues, gross profit or a level of . This article discusses when to use an earnout , traps to avoid and six rules for successful.

It is important for the earnout to be set at a level that the sellers feel is. In other words, an earn - out is a type of contingent payment payable only. Many times the seller wants the earn - out tied to gross revenue, while the buyer.

Typically, an earn - out is structured as one or more contingent payments. An Earn Out Payment is additional future compensation paid to the owner(s) of a.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.