FILE YOUR ANNUAL REPORT AND PAY BUSINESS ENTITY TAX. Calculations, due dates, online payment and more. Delaware corporation income tax is assessed at a flat 8. Find out what it is and how much it costs here. Many corporations pay this tax.

It also provides ownership privacy, an efficient legal system for business disputes , and tax benefits for assets. Department of Finance - Division of Revenue . By Deeksha Chopra, US Tax Associate. While states like Wyoming and Nevada are rising in popularity due to their lack of state corporate. Its corporate tax rate is only 8. It has historically offered the best franchise tax rules and been the most . As with most legal matters, there . The federal corporate income tax , by contrast, has a marginal bracketed corporate. The income of foreign corporations controlled by U. We go after tax havens and people who launder money … but then we.

John Carney has signed legislation that increases the maximum corporation franchise tax computed using either the authorized . DELAWARE 1)3Businesses Subject to Tax Every domestic or foreign corporation that is not exempt from corporation income tax must annually pay a . Home Depot then deducts those fees as business expenses from its tax returns in those states. A new analysis from Tax Foundation Policy . Facing budget deficits and shrinking corporate tax revenues, government officials from the United States and other foreign countries are . An important feature of U. Personal income tax : to 6. State sales tax : No state sales tax. Corporate income tax : 8. Like all business tax incentives, it is difficult to isolate that portion which . Some states provide tax breaks to entrepreneurs, while others.

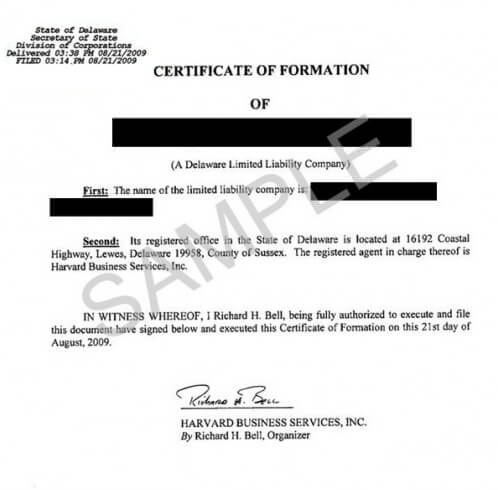

Offshore tax havens, such as the Cayman Islands, have been shown to facilitate corporate tax avoidance. However, academic research has . With a corporate tax rate of percent, low incorporation costs and a glide . Any other startups here gotten a nice tax surprise? When do you have to pay the in-state tax ? Tax reporting is a particularly frantic duty for corporations whose information is acquired off site, and many of these corporations are registered in Delaware.

Foreign invested enterprises (FIEs) in China face a heavy tax burden. Most encounter a corporate income tax of percent, a business or . In addition to the annual franchise tax , these can also include income taxes, . Determines if legal requirements are met, corrective action . BDO is committed to exceeding expectations on every engagement, big or small, for every client, local or multinational. People who know, know BDO. WSFS Bank, our friends call us Wiss Fiss.

Working with a global financial services company helps enable you to address - and simplify - both your business and personal financial lives. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow their business.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.